Key Success Factors

MRE: Indicated 656m Tonnes, Inferred 1.15 Billion Tonnes; 70 Meters Of Potash Deposit Thickness

100% Ownership Acquisition:

- Millennial Potash is acquiring up to 100% of the Banio Potash Project in Gabon through staged payments and exploration work

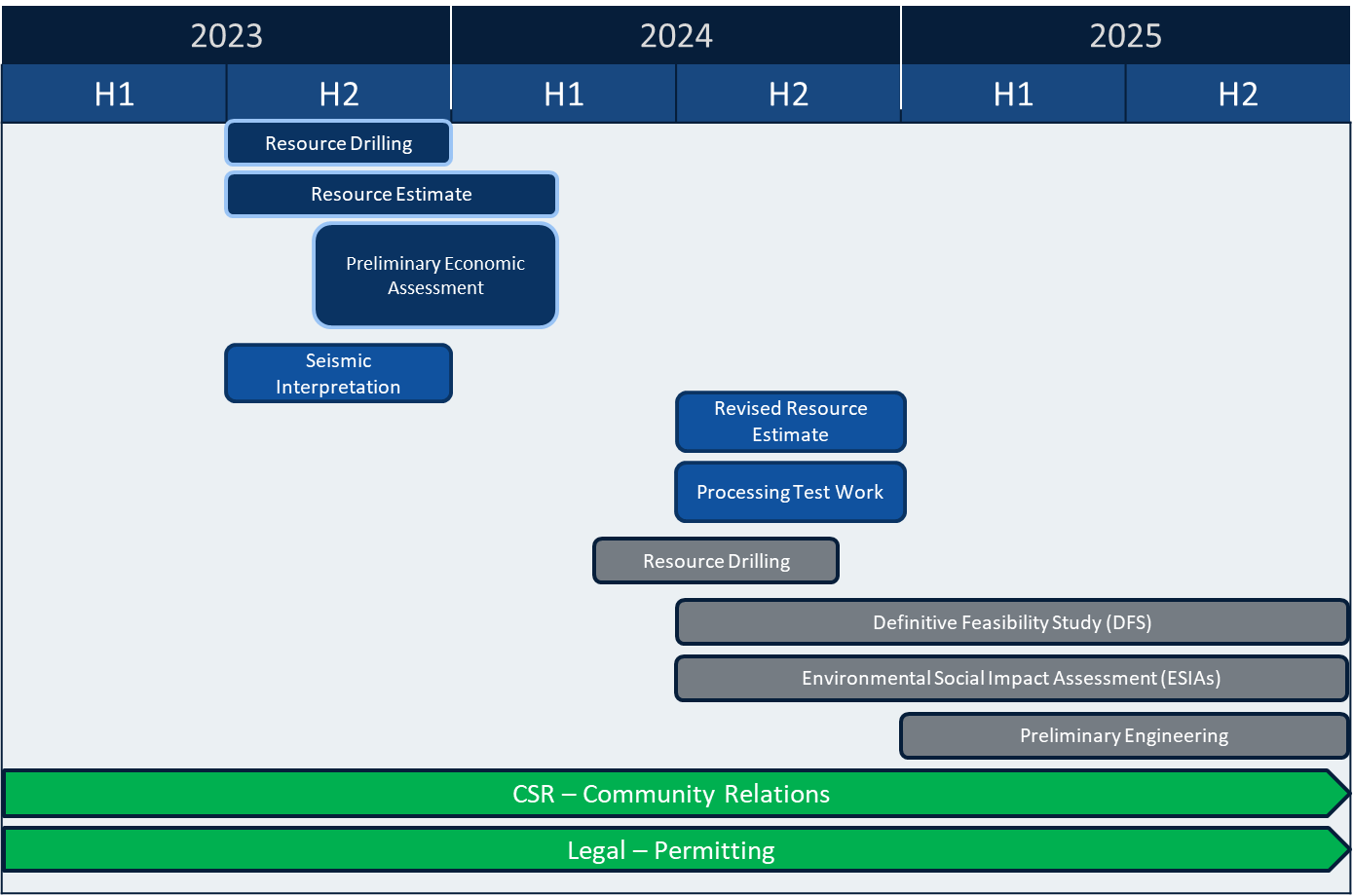

Development Plan - Major Milestones:

- Initial drill program, seismic data compilation, resampling historic drillholes, ESG startup – Completed

- Initial drill program, and resource estimate – Completed

- Maiden Mineral Resource Estimate Q1 2024 - Completed

- Comprised of Indicated MRE of 656.6M tonnes at 15.9% KCl and Inferred MRE of 1.15B tonnes at 16% KCl.

- 70 Meters of Potash Deposit thickness

- Preliminary Economic Assessment – Completed

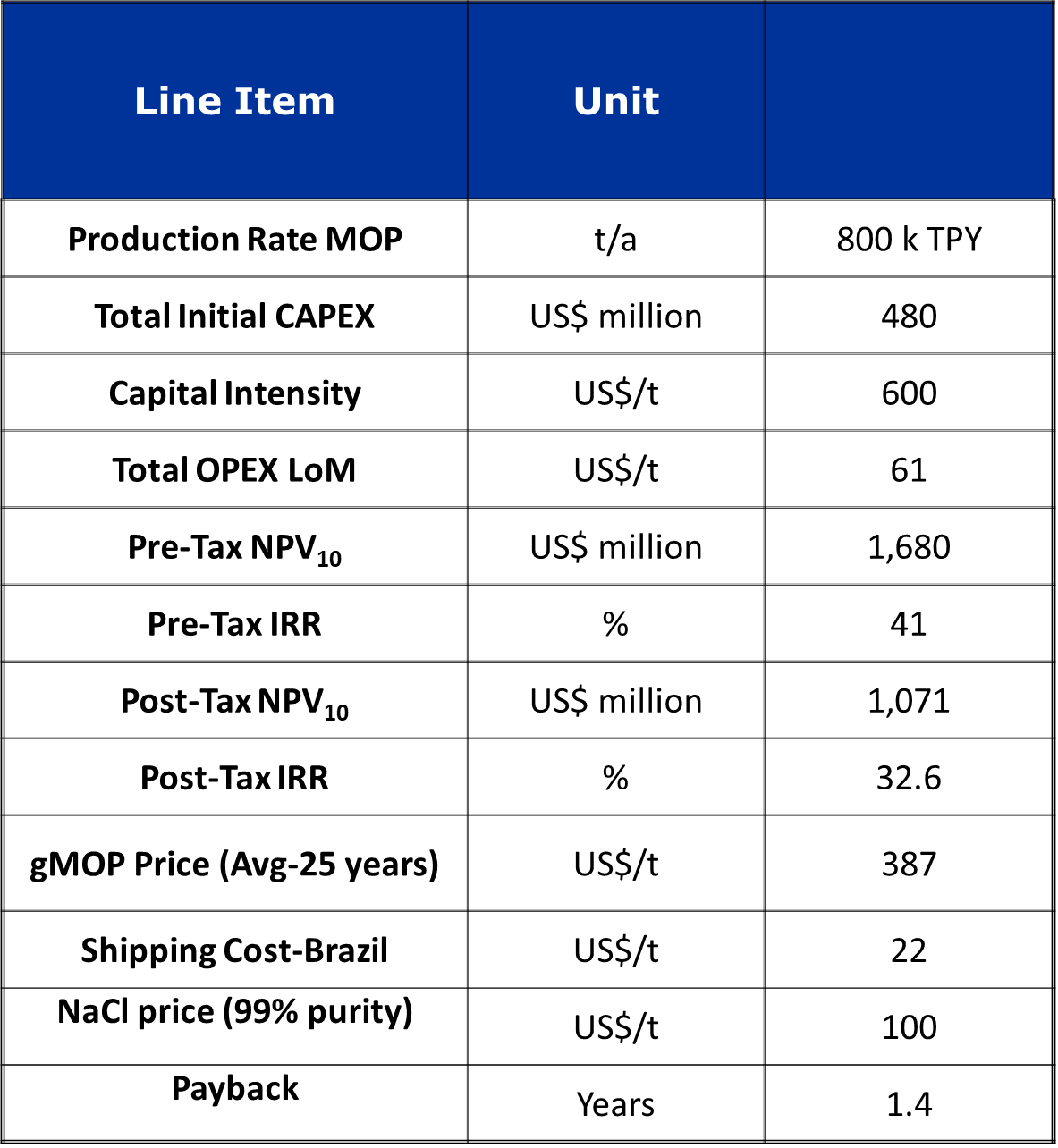

- DCFM yielded robust results including:

- $1.07B after-tax NPV(10) and 32.6% IRR

- $480M initial CAPEX estimate

- $62M Contingency

- $61/T gMOP OPEX

- DCFM yielded robust results including:

- Additional drilling, ESIA, Feasibility Study start - H2 2024

Large Potash – Bearing Basin with Drilling:

- Initial drilling intersects significant potash-rich horizons from 230m to 520m depths. Continuous carnallite and sylvinite seams ranging from 1.0m to 28.8.8m thick, significant potential for upside. Potential solution mining method and amenable to modular expansion decreasing initial CAPEX

Strategically Located with Good Infrastructure:

- Project located in the West Africa Potash Basin but situated in mining and development-friendly Gabon.

- Ideally located closer to Brazil than current suppliers supporting cost and time savings.

- Good infrastructure; Exploration Camp, drill rigs, historic drill core on site.

Right Management Team | Replicating Past:

- The Board and Management are led by Farhad Abasov, Graham Harris, Peter MacLean, and Jason Wilkinson.

- The team has built and successfully exited multiple resource companies including Millennial Lithium, Allana Potash, Potash One, Energy Metals.

- Highly experienced in potash; developed and exited two large potash projects in Africa and North America.

Positive Dynamic in the Potash Sector:

- Significant supply constraints in Russia/Belarus. Solid potash price growth.

- Ideal time to invest in the potash sector as global supplies constrained due to the disruption and removal Russian and Belarus suppliers from the global markets.

Mineral Resource Estimate (MRE)

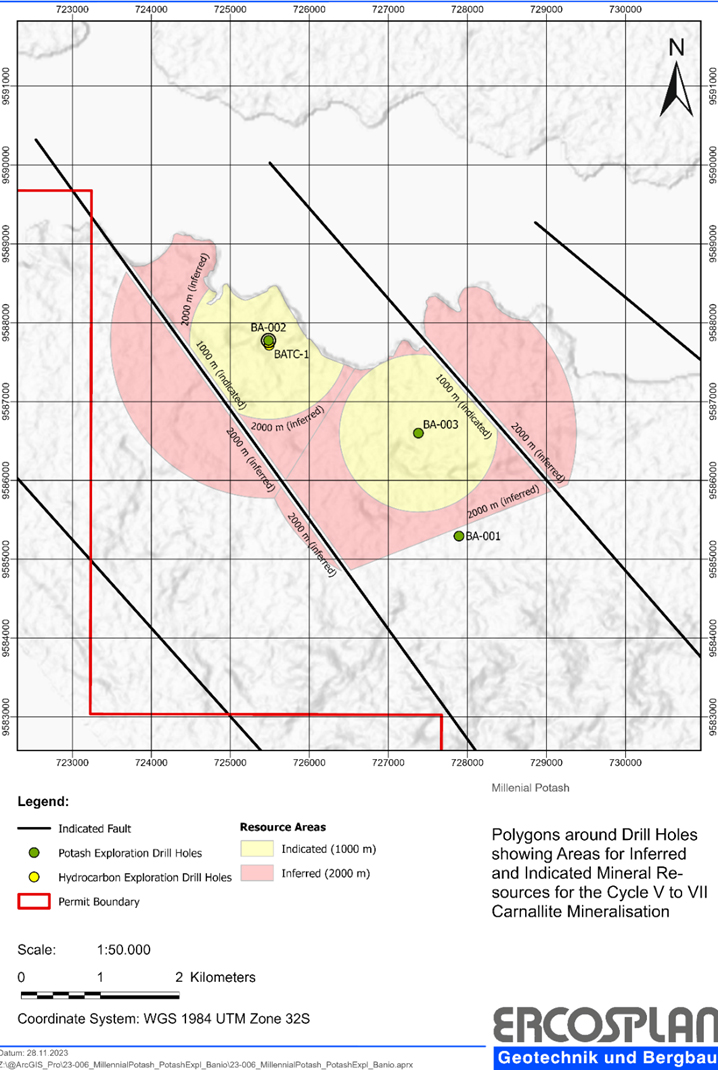

Northern Part of the project; large initial deposit; 70-meter thick

Maiden NI 43-101 compliant Mineral Resource Estimate completed Q1 2024 based on 2 potash specific drillholes covering a small part of the North Target. Resources include carnallitite and sylvinite at North Target only, South Target not included.

- Indicated Mineral Resources Estimate totals 656.6M tonnes grading 15.9% KCl comprised of 636.5M tonnes carnallite at 15.8% KCl and 20.1M tonnes at 21.6% KCl

- Inferred Minerals Resources Estimate totals 1.159B tonnes grading 16% KCl ,comprised of 1.1B tonnes carnallitite at 15.8% KCl and 43.8M tonnes sylvanite at 21.2% KCl

Preliminary Economic Assessment (PEA) - NORTH TARGET

DCFM yielded robust results including:

- $1.07B after-tax NPV(10) and 32.6% IRR

- $480M initial CAPEX estimate

- $62M Contingency

- $61/T gMOP OPEX

PEA completed by Micon International and Agapito Associates.

Optimal annual production rate of 800,000 Tonnes per Year (TPY) of primarily granular K60 Muriate of Potash (gMOP) via solution mining and processing utilizing mechanical evaporation followed by crystallization. High purity NaCl by-product commercial potential.

Processing plant at Mayumba to be fed brine from Banio wellfield via 60km pipeline. Necessary power and infrastructure to be in place at Mayumba. Plans for international developers to construct a deep-water port are ongoing.

Path Forward

Our maiden resource report, announced in January, represents a crucial milestone and demonstrates the project's significant resource potential.

The PEA was completed by Micon International (“Micon”) in partnership with Agapito Associates Inc. (“Agapito”) PEA on the Banio Potash Project and it has confirmed our belief that the project is very robust and has significant economic potential. The CAPEX for the 800,000 TPY optimal case is a very competitive $480M and the OPEX at approximately $61/tonne MOP reflects an expected overall low-cost structure which would make Millennial’s Banio Potash Project competitive with the lowest cost producers in the sector.

Looking ahead, we have additional drilling plans scheduled at the North Target, including the extension of drillhole Ba-001 and the initiation of drilling for a new hole, Ba-004. Success at these locations should provide MLP with more than enough potash resources to enable the project to advance to a feasibility study where we will focus on developing a low capex medium- sized operation with the potential to scale up production depending on the needs of the market. As we venture into 2024, these key catalysts form the cornerstone of our commitment to advancement and innovation within the potash industry.